Discovering an error on your tax return after you’ve already filed can be stressful. Whether you forgot to report income, claimed the wrong filing status, or missed a deduction, the solution is to file an amended return using Form 1040-X. However, tracking an amended return is a completely different process than tracking a standard return, and it requires a significant amount of patience. This guide will explain everything you need to know.

A Different Tool for a Different Situation

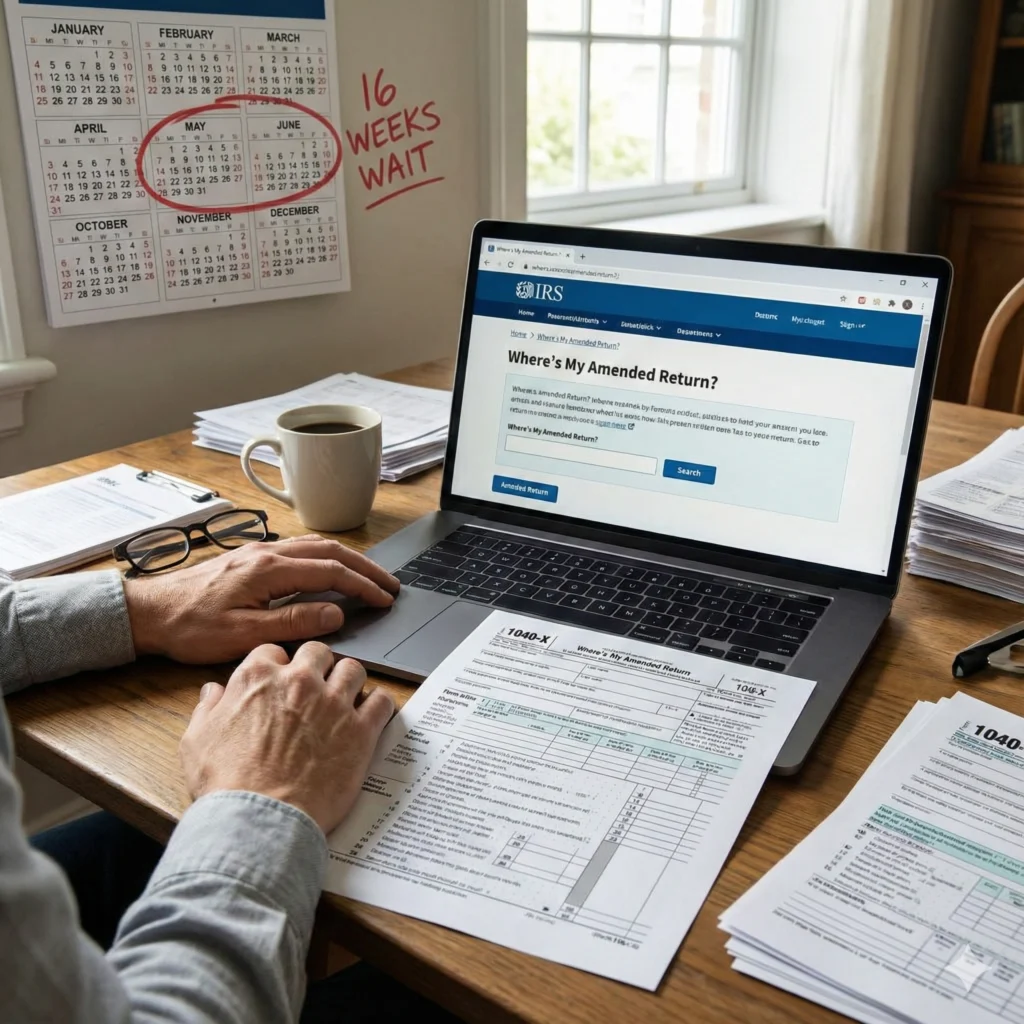

The most important thing to understand is that if you have filed an amended return, the standard “Where’s My Refund?” tool will not work for tracking it. The IRS has a separate, dedicated tool for this purpose called “Where’s My Amended Return?” (WMAR).

Many taxpayers make the frustrating mistake of repeatedly checking the regular “Where’s My Refund?” tool and seeing no update, not realizing they need to use a different system entirely. If you have submitted a Form 1040-X, you must use the WMAR tool, which can be found at irs.gov/filing/wheres-my-amended-return.

To check your status, you will need:

- Your Social Security Number (SSN)

- Your date of birth

- Your ZIP code

The Real Timeline: Managing the 16-Week Expectation

The single most critical piece of information about amended returns is the processing time. Unlike standard returns, which are typically processed within 21 days, amended returns can take 16 weeks or more to process. The IRS officially states that you should generally allow 8 to 12 weeks, but in many cases, it can take the full 16 weeks or even longer.

Why Does It Take So Long?

The reason for this extended timeline is that amended returns often require manual review by an IRS agent. The automated systems that process millions of standard returns quickly are not designed to handle the complexities of amended returns. An agent must physically review your original return, compare it to your amended return, verify the changes, and make the necessary adjustments to your account. This is a labor-intensive process.

Furthermore, your amended return will not even appear in the WMAR system until approximately 3 weeks after you submit it. So, if you check the tool immediately after mailing your Form 1040-X, you will not see any information.

For a comparison of these timelines with the standard refund process, you can refer to our main guide. [Click here to read the Federal “Where’s My Refund?” Guide].

The 3 Statuses of an Amended Return

The “Where’s My Amended Return?” tool will display one of three statuses as your return moves through the system:

| Status | What It Means | What You Should Know |

|---|---|---|

| Received | The IRS has received your amended return and it is in the queue for processing. | This status simply confirms receipt. It does not indicate that any action has been taken on your return yet. You may see this status for many weeks. |

| Adjusted | The IRS has made an adjustment to your tax account based on your amended return. | Important: “Adjusted” does not automatically mean you will receive a refund. An adjustment could result in a refund owed to you, a balance due that you owe to the IRS, or no change at all. The final outcome depends on the nature of the correction. |

| Completed | The processing of your amended return is complete. | The IRS will mail you a notice (a letter) explaining the final outcome of your amended return. This notice will detail any changes made to your account and inform you of any refund or balance due. |

It is essential to understand the “Adjusted” status. Many people see this and assume a refund is on its way, only to be surprised when they receive a bill instead. Always wait for the official IRS notice to understand the full picture.

When Should You Call the IRS About Your Amended Return?

The IRS explicitly requests that you do not call to inquire about your amended return before the 16-week processing window has passed. Calling before this time will not provide you with any additional information, and it ties up phone lines for taxpayers who have urgent issues.

You should only call the IRS about your amended return if:

- It has been more than 16 weeks since you submitted your Form 1040-X.

- The “Where’s My Amended Return?” tool has not been updated or directs you to call.

If you need to call, the official IRS phone number is 800-829-1040. Before you call, have a copy of your original return and your Form 1040-X ready. Be prepared for potentially long wait times.

Disclaimer: This article is for informational and educational purposes only. All content is based on public official information from the Internal Revenue Service (IRS) and State Revenue Departments. We are not financial advisors, accountants, or lawyers. For specific cases, consult a licensed professional or official government channels (.gov).

References

[1] Internal Revenue Service. “Where’s My Amended Return?” https://www.irs.gov/filing/wheres-my-amended-return

[2] Internal Revenue Service. “Amended Return Frequently Asked Questions.” https://www.irs.gov/filing/amended-return-frequently-asked-questions

[3] Internal Revenue Service. “Telephone Assistance.” https://www.irs.gov/help/telephone-assistance